A back-end job for a bank turned into an engineering partnership

The bank established its first cloud infrastructure, which broadened the reach of transaction services from the Netherlands, Germany, and Austria into 36 SEPA countries.

About the client

This information describes a real project, but we can’t name our partner at the time.

The bank provides trade financing for commercial customers through services of asset-backed capital lending, cash management, structured trade, and retail banking.

It operates in the Dutch, German, and British internet retail market as a subsidiary of eastern Europe’s largest private investment groups.

Country

The Netherlands

Industry

Fintech

Timeline

12.2020 - 05.2022

This information describes a real project, but we can’t name our partner at the time.

The bank provides trade financing for commercial customers through services of asset-backed capital lending, cash management, structured trade, and retail banking.

It operates in the Dutch, German, and British internet retail market as a subsidiary of eastern Europe’s largest private investment groups.

4%

Annual portfolio growth

$1.349M

The bank's total assets

€20M

Operating result for 2019

The challenge

The bank’s system depended on a commission-based payment gate from a global financial institution, which set conditions that made it harder for the business to pursue a European expansion.

The client’s cloud team faced a fixed deadline from the board that left no time to recruit additional developers for the job. There was also the concern that the expanded team might have to be disbanded after the project.

The product also needed a credible system architect that could design the infrastructure under strict EU banking regulations. All of this made the company source for a development partner.

Partnership goal To transform a traditional bank into a truly European financial institution with growth empowered by cloud computing services

Before

The bank wanted to expand onto the cloud, but a third-party pay gate limited the choice of currencies and the number of countries a transfer could go to

After

Our joint team unblocked the bank’s technology growth by creating a completely new payment process based on reliable AWS services

The Software House hand-picked professionals who joined our partner's team under a hybrid model

We worked on

Team formation

The bank’s cloud division required more Frontend/Backend developers on board.

The Software House filled the talent and knowledge gap in weeks where the company would have needed months to do so. The line-up included 2 QA Engineers, 12 Developers, 3 DevOps, 2 Product Designers, an Architect, and 2 Project Managers.

They joined our partners ranks under their PO’s leadership, but also worked directly with technology leaders from the Cloud, Testing, and Salesforce units, and with business analysts.

Our partnership

In half a year, our joint team established the bank’s very first cloud infrastructure for transaction processing, which was then integrated with the legacy system and the process for observability.

Because developers worked with pre-built components, the company prepared just in time to get a SEPA certificate, which added dozens of new countries customers can transfer to.

Technology choice

React (frontend), Node (backend), Typescript, AWS services, Serverless, Terraform, Scali (analytics) + Python (data analysis), Mambu, Salesforce.

What our partner achieved

The Software House’s architect mapped out a new infrastructure to implement the payment gateway. We used Amazon S3 for storage, Form3 for payment processing that enabled the use of all SEPA services, and Mambu as a ready-made engine with a range of banking services. This first phase took 6 months.

The new cloud setup allowed the client to check all the boxes needed for a SEPA certificate, issued by the European Payments Council only a few times per year, which the project team secured.

With the SEPA certificate, the bank offered customers transfers in Euro across Europe’s 36 countries, where such were previously limited to the Netherlands, Germany, and Austria.

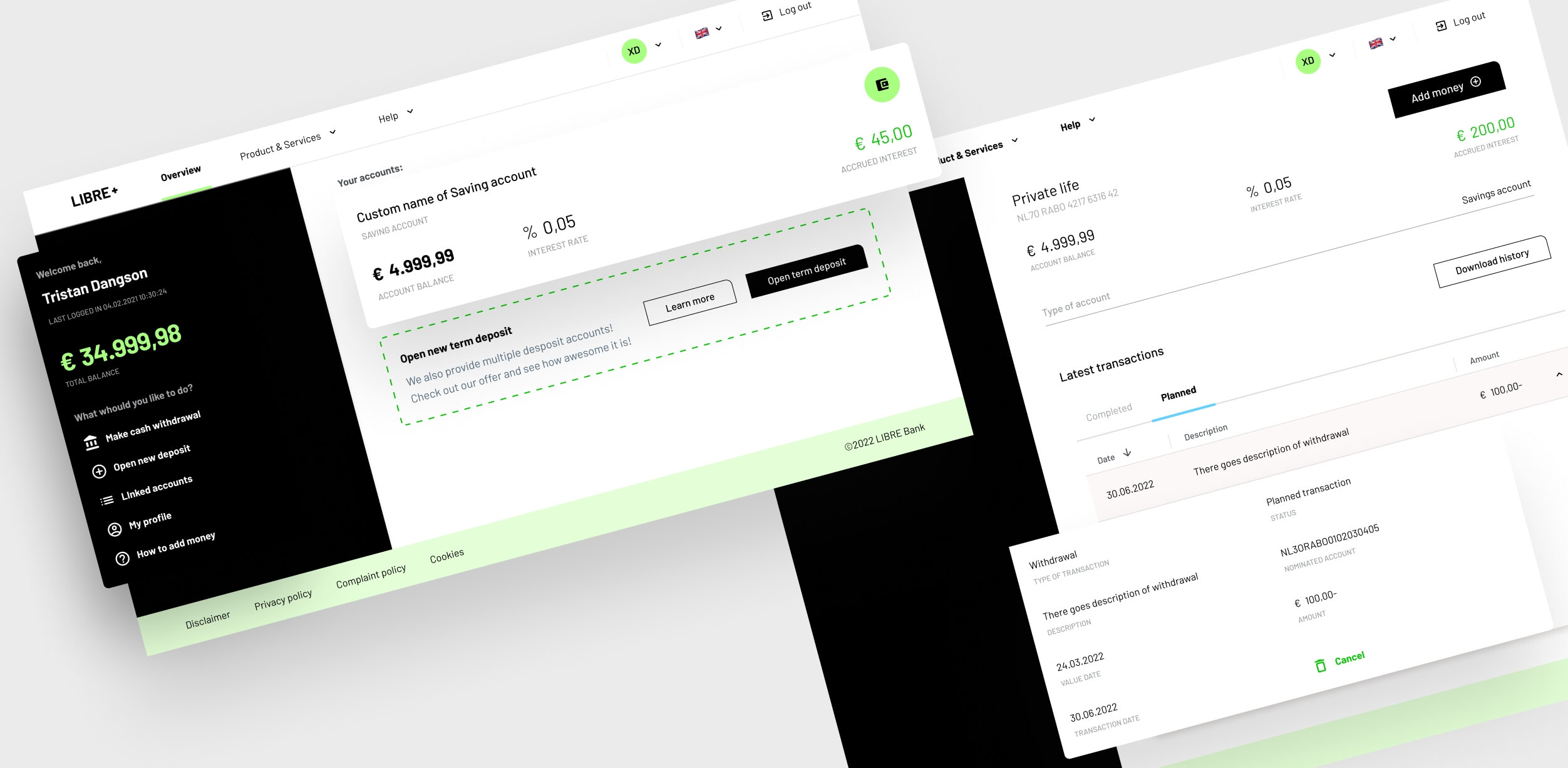

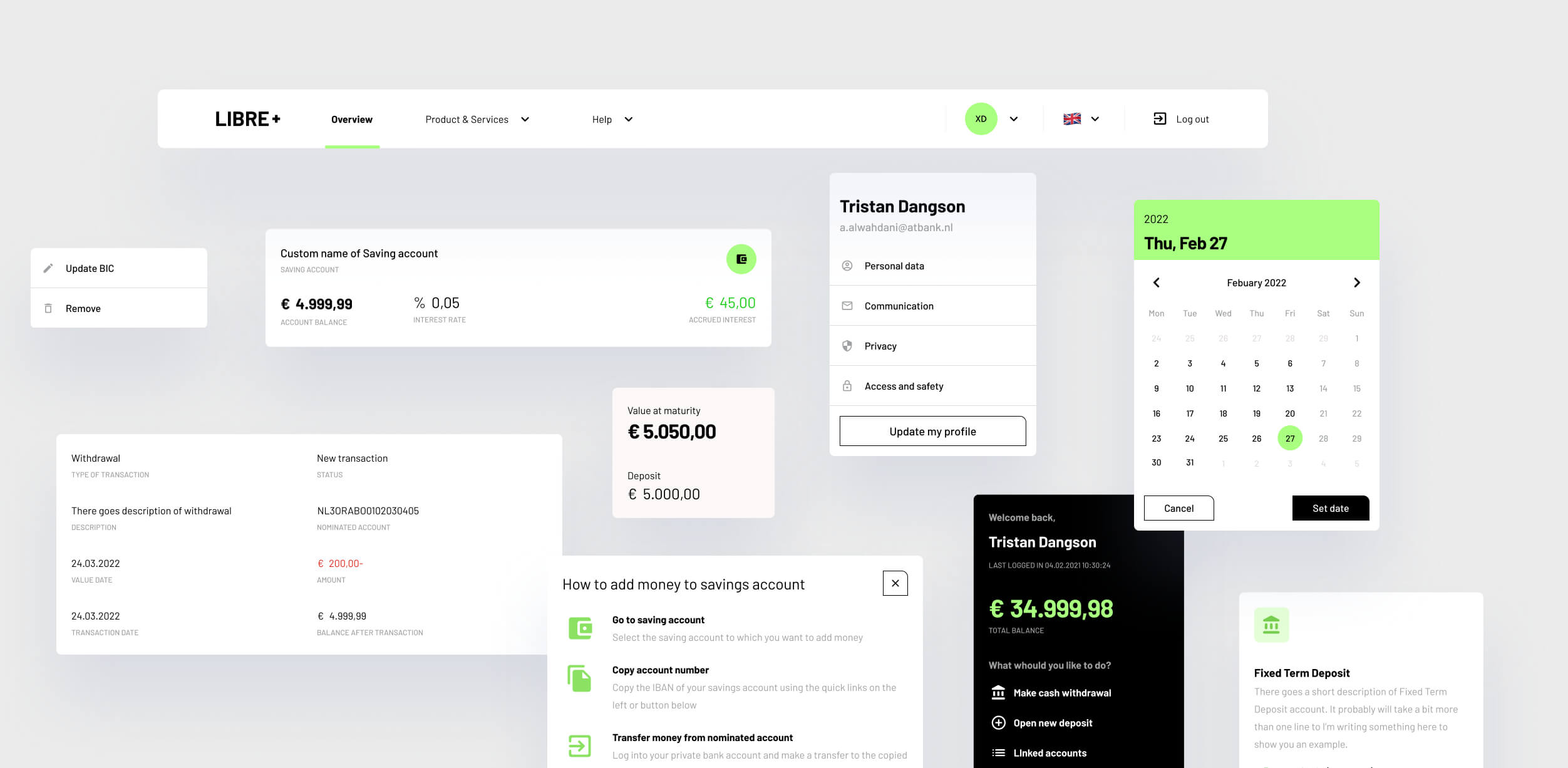

Two months into the project, the company asked The Software House’s developers to build a new retail banking platform for the Dutch market. A small group of early adopters then tested the platform.

Together with our partner’s developers, we proceeded to build the website and the client’s web app for registering deposit accounts.

Reach a breakthrough with your project just like our partner did

For over 9 years, tech leaders from 10 industries entrusted The Software House’s engineers with refactoring, development, and cloud computing works.

Work only with scalable technologies

Expect a software solution designed for stability, usability, and scalability thanks to next-gen technologies used at The Software House: microservices, serverless, and cloud computing

260+ professionals available

People with the skill set your project needs are within reach – developers, cloud engineers, DevOps, architects, and product designers

Rated 4.8/5 on Clutch.co

We follow a simple mantra that worked for 160+ software projects we delivered with success — everything we build must be of great value to you and your clients

"They are responsive and helpful and willing to listen."

Said by CTO Micha Roon of the Energy Web Foundation in a ★5 review. He delivered a rapid-development project with us in just 6 weeks. How can we help you?