A development partnership powered a FinTech client's expansion in the UK

The client secured their position on the market by providing a simpler & faster digital loan application process. With The Software House’s help, their product helped British businesses secure €10M.

About the client

This information describes a real project, but we can’t name our partner at the time.

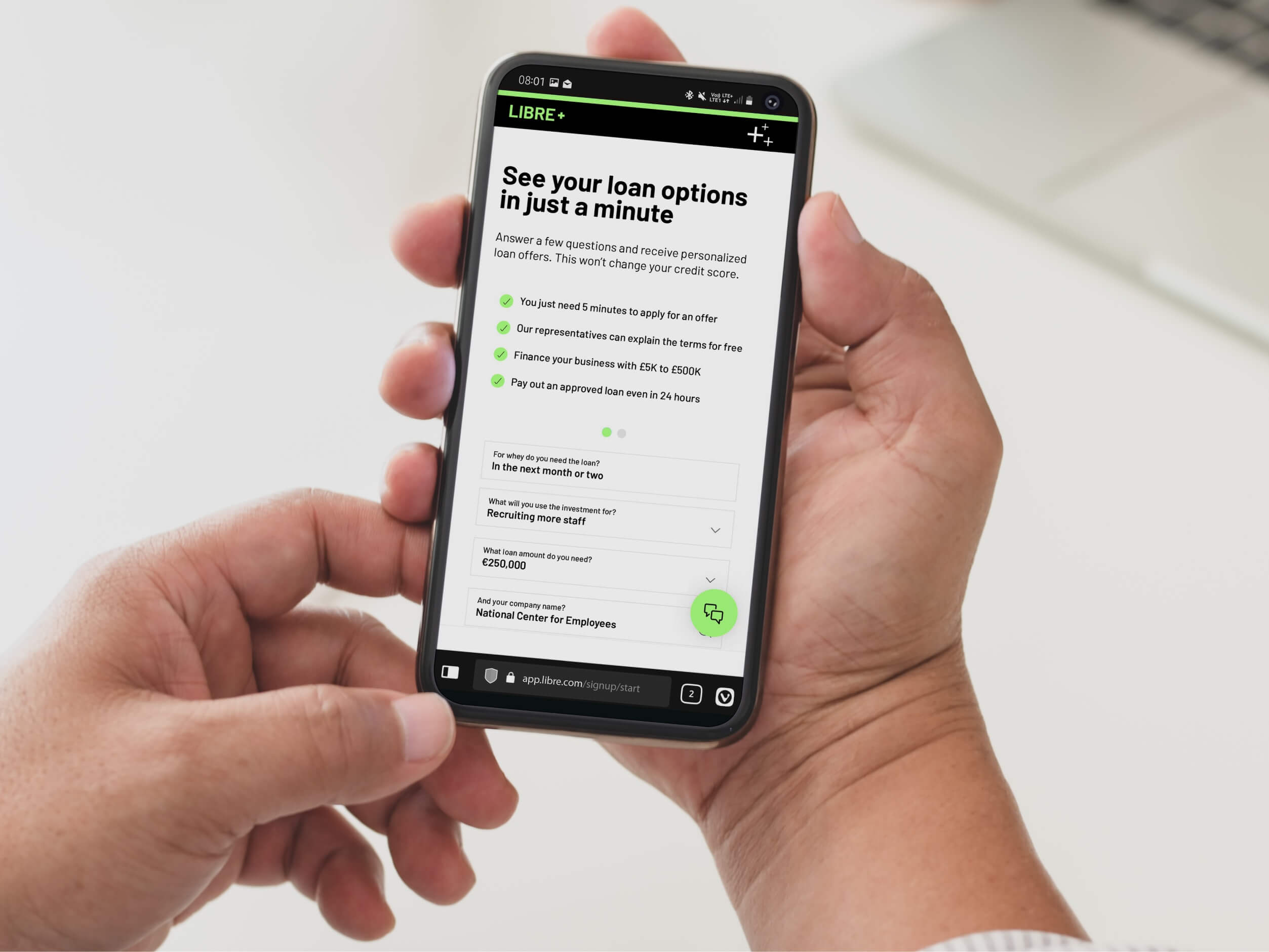

Our fintech client creates loan solutions for SMB’s, aiming to offer better terms and service than traditional banks. Imagine being granted a business loan completely online — and at a speed.

Their digital product is comparably faster than known lending platforms in the UK.

The client worked with The Software House’s team of developers and engineers to digitize the end-to-end lending process for British businesses.

Country

United Kingdom

Industry

Fintech

Timeline

08.2020 - 01.2022

This information describes a real project, but we can’t name our partner at the time.

Our fintech client creates loan solutions for SMB’s, aiming to offer better terms and service than traditional banks. Imagine being granted a business loan completely online — and at a speed.

Their digital product is comparably faster than known lending platforms in the UK.

The client worked with The Software House’s team of developers and engineers to digitize the end-to-end lending process for British businesses.

150+

acquired business clients

★4.7

Trustpilot score (excellent)

£10M+

issued in loans

The challenge

As lending leaves no room for error, most organizations employ auditors to verify applicants under the scope. A business can wait between 60 to 90 days on average to get clearance (Fundera).

The client’s ambition was to automate the loan process completely to support businesses that needed to receive credit much faster. The bar was set at 5 minutes for an applicant to access the indicative loan offer.

Each loan application requires background checks with several institutions with page after page of data cross-referencing. The client needed high trust in the business they were lending to, knowing they are who they say are that they can afford repayments.

The company’s development team faced unbending business requirements that fintechs face. It was time to call for backup.

Partnership goal To build a loan platform focused on excellent user experience with the use of cloud computing

Before

The client’s staff needed direction in development to ship releases faster, update their architecture, and implement cloud automation with no flaws

After

With the help of a software partner, the product turned from an MVP into a popular loan platform that acquired 150+ business clients

The Software House hand-picked professionals who joined our partner's team under a hybrid model

We worked on

Team formation

The client’s market expansion in the UK required more Frontend/Backend developers, DevOps, and QAs on board.

The Software House filled the talent and knowledge gap in weeks where the company would have needed months to do so. The line-up included 3 QA Engineers, 8 Developers, 2 DevOps, and 1 Senior Project Manager.

They joined the client’s ranks under their PO’s leadership but also worked directly with the CTO CEO, and the PM. We worked in the Agile methodology with two-week sprints.

They brought in the right talent at the right time with the right expertise. We’ve been happy with the quality of their work. I don’t think there’s anything they can improve on.

Our partnership

For over a year, our joint team was adding features, automating bank processes, and ensuring no-compromise cloud security and performance. The client’s product continued to acquire dozens of business clients that then received loans of over £10M.

Technology choice

React (frontend), Node + Python (backend), AWS, AWS call, Serverless, and BitBucket.

What our partner achieved

We first refined the system’s 3-year-old code to prepare it for integration with new cloud services. For that to happen, The Software House introduced planning, sprint, and retro meetings.

The team then redesigned the client’s website. We build an automated background-check service for loan applications that supported the company’s rapid user growth.

Features we introduced included a custom admin/user panels, a backend API for frontend, and AWS Connect in place of Twilio for the call center. Then, we integrated Salesforce with AWS Connect.

The team also switched from Buddy to BitBucket for pipelining which dropped deploy time from 1.5 hours to only 10 minutes.

The next step

The Software House is transferring the company’s services onto several AWS clouds to meet the resilience and security requirements set by investors.

Reach a breakthrough with your project just like our partner did

For over 9 years, tech leaders from 10 industries entrusted The Software House’s engineers with refactoring, development, and cloud computing works.

Work only with scalable technologies

Expect a software solution designed for stability, usability, and scalability thanks to next-gen technologies used at The Software House: microservices, serverless, and cloud computing

260+ professionals available

People with the skill set your project needs are within reach – developers, cloud engineers, DevOps, architects, and product designers

Rated 4.8/5 on Clutch.co

We follow a simple mantra that worked for 160+ software projects we delivered with success — everything we build must be of great value to you and your clients

"They are responsive and helpful and willing to listen."

As said by CTO Micha Roon of the Energy Web Foundation in a ★5 review. He delivered a rapid-development project in just 6 weeks with our developers. How can we help you?

Headquarters

ul. Twarda 18

Warszawa, 00-105

Poland

ul. Dolnych Wałów 8

Gliwice, 44-100

Poland

The Software House

2025 The Software House | All rights reserved

2025 The Software House | All rights reserved