29 November 2024

“It’s all about transparency” – InvestEngine’s Alex Rupin on product-tech harmony in fintech

How does a fintech company create seamless collaboration between departments in an industry where product and technology teams often operate in isolation? InvestEngine’s Chief Product Officer Alex Rupin reveals how they break down conventional barriers and foster true cross-functional development.

The CTO vs Status Quo series studies how CTOs challenge the current state of affairs at their company to push it toward a new height … or to save it from doom.

“You don’t want teams where only heads of departments are talking”

What do you need to succeed in fintech? For Alex Rupin, the secret lies in the carefully orchestrated interplay of product and technology teams. Like the leaders of an expedition, both teams play huge parts in charting the future course of a fintech company.

While many organizations struggle with siloed departments and disconnected development processes, InvestEngine has found a way to bridge this gap. In this discussion with CPO Alex Rupin, you’ll learn about:

- the optimal team structure for collaboration,

- the secret feature that accelerates cross-team development,

- the key to product-tech alignment,

- the tools for breaking down silos in departments.

Discover Alex’s formula for successful product-technology collaboration.

About Alex & InvestEngine

Bio

With over 20 years of experience in the digital industry, most of Alex’s background is in design. He led agency teams, worked as Head of Design, Product Manager, co-founded iBride.com, and became Chief Product Officer of InvestEngine in 2016.

Expertise

Product management, agile methodologies, design, UX/UI

InvestEngine

Award-winning investment platform with accounts for individual investors and SMEs. InvestEngine is unique thanks to its focus on ETFs and carefully designed suite of products.

InvestEngine’s vision

Eric Ignasik: Hello, Alex! I saw that InvestEngine won the 2024 Finder’s People’s Choice Award in the investing category – the second year in a row. What does this award mean for you personally and for your company?

Alexander Rupin: It’s a unique award because it’s based on customer feedback. It’s great to see that we’re achieving this for the second year in a row and that a smaller startup can beat market whales with huge budgets. It tells us we’re on the right track.

If you look at the list of platforms considered, most of them are just trading platforms where you trade popular stocks like Tesla, Apple, or Google. They’re not necessarily the best investments.

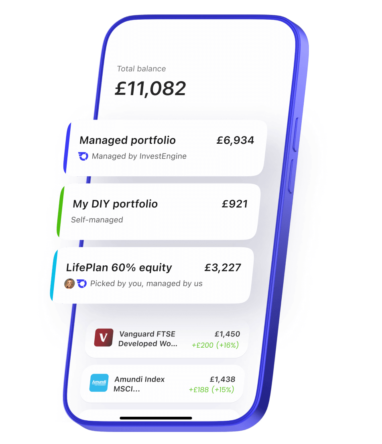

Our product is different. InvestEngine stands for simplicity and a portfolio-based approach. With that comes diversification and automation. We only focus on ETFs, which gives us an advantage because they have great benefits. In the UK, you don’t pay stamp duty tax on ETFs; they’re inherently diversified and have low fees.

The feedback we hear most from our customers is that our product is simple and easy to use. I think that’s a big driver behind the People’s Choice award – it reflects how much our focus on simplicity and a great user experience resonates with them.

I’ve listened to your Head of Investments, Andrew Prosser, and his session for the Good Money Guide. It seems that InvestEngine focuses a lot on investing novices. Is this a correct assumption? How important is it for you to focus on beginners?

It’s essential because most people are familiar only with the basics of investing. Few know all the available investment products or how to build a balanced portfolio on their own. Many simply know about ISAs or that they can buy stocks and shares. But our customer base spans everyone from the absolute beginner to sophisticated investors looking for an easy to use platform for long term growth.

What sets us apart from pretty much everyone in the market is that we offer something for everyone, from a Do-It-Yourself (DIY) service to our Managed Portfolio service (MPS), with LifePlans sitting in the middle, offering planned portfolios you’re able to select based on your appetite for risk.

The MPS product is designed for people who may not have the time, experience, or desire to build their own portfolio, or who simply prefer to set it up and let it manage itself.

You complete a risk questionnaire, and then we give you a risk score, which selects one of our 10 MPS portfolios. The risk scores range from low to high, with the difference being the ratio of equities to bonds. The score takes into account your investment horizon, age, and risk preference.

It seems that innovation is the order of the day at InvestEngine. Typically, product leaders analyze user needs and steer the product roadmap based on feedback. Is this still the best approach?

Listening to our users is essential for shaping our product. We engage directly with our community, have regular conversations with clients to understand their experiences, and actively gather insights from our support team and Net Promoter Scores. This helps us stay close to what users value most, even as we pursue a broader product vision.

One thing you can’t get from clients is innovation. Nobody would have told Apple they needed an iPhone. For instance, our ETF-only focus – if we’d simply followed typical user requests, we might not have prioritised this unique, streamlined approach for portfolio building.

It’s important to have a product vision and work with the business team to identify strategic objectives to make sure your product is different. If you look back at the Finder awards again, all the other products except InvestEngine were really similar. You navigate to the right section, browse, buy, and see your list of investments. There is no portfolio approach or specific focus like we have on ETFs. That gives us an advantage.

Product-tech relationship in fintech

The overarching topic for this conversation is the interplay of Product and Tech departments, and you’re the perfect person to talk to about this. In our interviews, we often come up against the dilemma between never-ending technological innovations and product-oriented development. In some companies, the power dynamic leans more in favor of one or the other. How do you see the product-technology dynamic?

We were lucky enough to work with the core team for a while, even before InvestEngine. For example, our CTO, Daniel, and I worked together for 15 years. We collaborate quite a lot between the product and technology teams.

The most important thing for a healthy product-technology dynamic is to stay transparent. We have a flat structure and include our team leads and CTO in all planning sessions, which occur several times a week. I manage the roadmap, populated by both the product and business teams based on strategic objectives.

We put it all out there and discuss what’s on the horizon. The technology team can see what’s coming, and we can collaborate early in the process. We always keep the customer and cost benefits in mind. Occasionally, there’s a push to explore new technologies, but we always take a step back to discuss the purpose behind it and how it will benefit our clients or support our goals.

One of our recent guests, Björn Helgeson of Mindler, said something interesting that I’d like to hear your take on. He noted that technical companies could benefit from trying a technology-first approach in which you try to push the limits of new technologies by developing MVPs very quickly. That way, you could find new and interesting product ideas, but it would be the drive toward technological innovation that would power it rather than a calculated product approach.

What do you think about it?

Both approaches can definitely work together, but it’s important to stay balanced, especially in fintech. While pushing the limits of new technologies can be exciting, we keep an eye on whether these innovations will genuinely benefit our users or align with our long-term product vision.

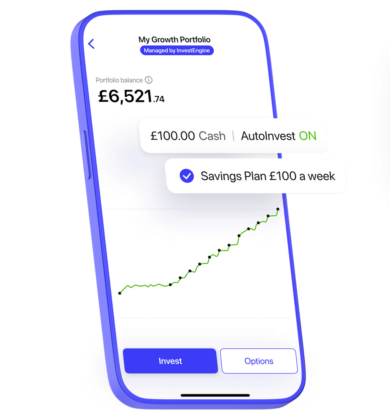

At InvestEngine, we value MVPs because they allow us to test ideas quickly and cost-effectively. We try to cut down projects to their essentials for testing, which helps us stay lean and focused. However, when we find an approach that benefits our product and users, we make sure to dedicate resources to iterating and building it out.

Our use of feature toggles also allows us to experiment without pushing these projects to clients too early. With five or so projects running internally at any time, we can test MVPs while maintaining compliance, which is critical in fintech. So, while we love trying out new ideas, we’re mindful of the balance between innovation and product focus.

The feature toggles are very interesting. Did you start using them from the get-go, or did you implement them at some point because you saw a need?

We used feature toggles in our previous projects, but they didn’t have as much value as with fintech. Here, you can test stuff that you can’t show real clients within an environment that has guardrails and internal users.

Our ops team is aware these are internal users, and we can use manual processes. Internal users can wait as long as needed while ops do something manually, and we test the next stage. I think it’s one of the most important and useful features we have in development.

Fintech has always quickly adopted new developments like cloud, machine learning, biometrics, blockchain, or AI. Where do you think the line is between implementing these technologies just for the sake of it and using them for increasing business value? Is there even such a line?

In fintech, it’s easy to chase every new technology, but we try to stay focused on what actually adds value. Before integrating something like AI or blockchain, we look carefully at the tangible benefits for the product and our users. We always do a cost-benefit analysis to make sure it’s worth it and won’t just distract us from our core goals.

Cloud computing, for example, was a no-brainer for us because of the flexibility and scalability it offers over legacy systems. AI is another story — it’s powerful and has a lot of potential, but it’s also expensive and resource-intensive. If you’re not careful, it can end up hurting your product or straining your resources.

We take a selective approach, implementing technologies that align with our main objectives. It’s about balancing innovation with staying focused on what really matters.

Fintech CPO challenges

A recent Deloitte report explores fintech organizations’ ability to access talent, capital, demand, and adaptation to regulation.

Let’s start with the talent aspect. How much should the tech and product departments or leaders shape the recruitment process in fintech? Should there be a unified line between product and tech, or should they be separate?

Collaboration is central to how we approach recruitment at InvestEngine. Our CTO takes the lead on hiring tech talent because they have the expertise to assess technical skills, while I focus more on UX talent and designers. That said, we often collaborate, and there are interviews where we’re both involved to make sure candidates align with our company’s culture and needs.

Even if I’m not part of the backend developer interviews, it’s important that the CTO ensures every hire fits our values — things like transparency, collaboration, and working within small, cross-functional teams with a flat structure.

We’ve also struck a great balance by hiring skilled talent from Eastern Europe. It’s cost-effective, but the technical expertise is excellent. With small, focused teams and a strong emphasis on MVPs, this approach has helped us stay fast and agile.

The next aspect is capital. Early on, fintech startups often strongly compete for seed and scale capital. Tech and product leaders may look at the company from different perspectives, but they also work closely together on projects early on if they see direct financial gain and growth.

Would you say that in the early period, the need for capital powerfully unifies the product and development teams and that, over time, those departments may diverge as they become more comfortable and have the capital to innovate?

In the early stages of a fintech startup, the need for capital naturally brings product and tech teams together because both are focused on proving value to investors. At InvestEngine, this shaped our approach from the beginning — we’ve always prioritized being frugal and effective, making sure every decision contributes to growth and aligns with our long-term goals.

Even now, as we’ve grown and manage significant AUA with a larger client base, we’ve kept that early-stage mindset. We’re careful with capital, staying lean and focused on delivering value to both our clients and investors.

As startups mature and budgets become more flexible, it’s natural for product and tech teams to sometimes diverge in their focus. But at InvestEngine, we’ve managed to avoid this by staying aligned through planning and shared goals, making sure we remain connected as we scale.

For fintech organizations where product and technology teams are more siloed than at InvestEngine, what would be some best practices for leaders to cooperate more on the product roadmap?

Strong collaboration between product and tech teams has always been a priority for me. At InvestEngine, we’ve built our process around transparency and inclusivity. We involve both product and tech not just in high-level planning but also in day-to-day work, like sprint planning. This helps us spot and fix potential roadblocks early.

Collaboration isn’t just about leadership, though. For instance, our designers regularly review their work with developers or give presentations to explain their designs and gather feedback. Every six weeks, business and development teams share updates, which helps everyone stay aligned and connected.

One thing that’s worked really well for us is giving every employee a budget to use our product. When developers actually experience the platform, they naturally see it from a user’s perspective. This often leads to useful observations, like, ‘This message isn’t clear when I click here,’ which helps us improve the product.

Let’s talk about policy and regulation. I imagine there’s both a technological aspect, like using blockchain automation for compliance work, and a product aspect, like developing KYC capabilities. Do you see potential clashes or opportunities for cooperation regarding regulation between product and tech departments?

There’s always potential for clashes between product and tech teams when it comes to regulation because they tend to look at things from different angles. Product is usually focused on creating a seamless user experience, while tech is more concerned with ensuring compliance from a backend perspective. If these priorities aren’t aligned early, it can lead to friction.

At InvestEngine, we’ve made this an opportunity for collaboration. When a project starts, we involve the compliance team alongside product and tech to align on requirements and avoid surprises later. This way, everyone’s on the same page from the start.

For example, compliance might need a risk warning that could clutter the interface. Instead of seeing this as a roadblock, our designers work with compliance to find ways to meet the requirements without compromising the user experience—whether that’s through on-page elements, notifications, or other creative solutions.

On the tech side, tools like feature toggles are invaluable. They allow compliance to test changes in a safe environment without slowing down development. This ensures compliance standards are met without disrupting the product roadmap.

You said the compliance challenge is big in the UK, but would it be right to say that it’s less scalable than on the continent? For example, if you are active in Germany and compliant there, then since it’s EU, you’re probably close to being compliant in France and Spain, but the UK is probably less scalable in that sense.

Oh definitely. Within Europe, it’s much easier to be regulated in one jurisdiction and then pass your regulatory compliance to other countries. But being compliant in the UK pretty much means you’re going to be compliant in the EU as well if you decide to go that way.

Product-technology relationship in a fintech company – wrapping up

Given what we’ve talked about and your experience, what do you think are the most important pillars of successful product-tech cooperation in the fintech context?

I think transparency and flat structure are essential. You don’t want teams where only heads of departments talk. Everybody should talk to everybody, and you include people on calls from the very early stage of a project to get their experience and feedback.

Having smaller cross-functional teams is really important as well because you’ve got product knowledge and tech knowledge within the teams.

On a side note, do you think the CTPO (Chief Technology Product Officer) role is a good idea in an organization like yours?

It could work in some organizations, but it’s a lot for one person to take on. Tech and product are quite different areas, with their own priorities and expertise. Balancing both effectively would depend a lot on the specific organization and the person in the role.

In most cases, having separate leaders for tech and product makes more sense because it allows for sharper focus and better collaboration. Combining the roles might work in smaller teams or very specific situations, but I wouldn’t see it as the default approach.

Resources

Can you recommend some learning resources about the technology-product relationship in fintech? Any podcasts, books, or anything else you like?

People often recommend books and podcasts that are at the top of “what you should read” lists. Just Google them or go to Audible and search for “product.” You should definitely read those for general knowledge.

But I would specifically recommend the Fintech Blueprint on Substack. I find it really useful. They do deep dives into products, fintech, and the industry’s future. It’s not free, but it’s an amazing resource.

Also, having accounts with other players in the market helped us a lot when we came into fintech without much fintech experience. This applies to any product. Register and try using other products. With fintech, it’s particularly important because you build up history, get newsletters and push notifications, and see what’s happening with their products.

And don’t just focus on products in your market – go global. For fintech, have accounts with US and international companies. This helps broaden your knowledge of competitors and what they’re doing and sometimes can act as a resource for you if you see something great that you’re not doing.

What’s next? 5 product vs technology in fintech tips for CTOs to implement

Based on InvestEngine’s experience, here are specific actions for fintech companies to enhance product-technology collaboration:

- Implement feature toggles to test new features of your financial products internally before public release, allowing both product and tech teams to validate functionality while maintaining compliance requirements.

- Include compliance teams in initial planning to ensure regulatory requirements for financial institutions are considered from the start, preventing costly revisions later.

- Establish cross-team planning sessions where product, tech, and other team leads discuss upcoming financial technology projects to align and prevent potential roadblocks.

- Allocate product testing budgets to employees across departments, encouraging developers and technical staff to experience the product from a user perspective.

- Set up regular meetings where business and development teams share their work to ensure full transparency.

With a strong product-technology alignment, any fintech can cater to banking services successfully and compete with financial industry behemoths!

Do you want to find out how InvestEngine can help you build and manage your ETF investment portfolio?

ETF has options for both individual and business users. Check out the website for free resources and get started!