23 August 2024

From concept to capital. Lipefi's instant prototyping delivers user feedback in just 3 months, helping secure investor funding

In the fierce fintech competition, saturated with new products, Lipefi has not just envisioned but executed a never-done-before concept that started with instant prototyping and led to a viable business that secured them rounds of funding. And all it took was only 3 months of development process.

About Lipefi

Lipefi is a company from Brussels, Belgium creating financial products designed for startups and scale-ups.

Their mission is to help startups manage their finances more effectively and optimize their cash flows. One of Lipefi’s main offerings is a custom credit card for startups and a range of digital control and planning tools.

Business goal – acquiring investors

The Lipefi team wanted to create an application for managing company cards and controlling the budget.

The project’s requirements were as follows:

- creating a clickable, high-level app prototype,

- improving Lipefi’s visual identity (including a new logotype),

- emphasizing best UX practices,

- 6-7 week deadline for the entire project,

- operating within a small budget.

After that, our partner used the application to participate in investment rounds and present their great idea to potential investors on a custom-made, working prototype. This way, Lipefi hoped to make an unforgettable impression on business people who may be willing to invest in releasing their software.

Our approach to Lipefi’s fintech project

- Analyzing user needs to find the business advantage

Multiple financial products are around, and standing out in the crowd is increasingly important. To verify the viability of a fintech solution, find answers to these questions:

- Why do users choose your product?

- What do they want to accomplish?

- How do they tackle the task?

- Making data-based decisions

Information is key; without good metrics, your business won’t reach its full growth potential. It is vital to continually test your assumptions and be open to adjust to changing customers’ needs.

Managers or company owners sometimes continue investing in features or products without proper user discovery. Sometimes, great business niches are overlooked due to the neglect of continuous user research. So find your specialty and build market value on it.

- Keeping it simple

Simplicity is essential in fintech design. In the fast-paced world, users expect immediate results. Research says you have 8-10 seconds to keep the user’s attention. This is especially important in fintech, as people tend to have less patience when their money is at stake. To keep customers relying on your product, enable them to complete tasks smoothly and quickly.

- Taking care of hierarchy and consistency

The consistency of interface elements affects the perceived quality of your product, so don’t forget about aesthetics. A structured information hierarchy and well-thought-out user flow are essential. Present your offerings logically and take some time to eliminate any dead ends in your product.

- Marketability

According to IPSOS, 72% of American consumers buy products based on their brand packaging design, so your company needs to look attractive. People buy with eyes, and looking professional is crucial in a fintech environment, where users entrust and deal with their money. Don’t forget about marketing assets! You’ll need them for presentations, posts on social media, and in-person meetings.

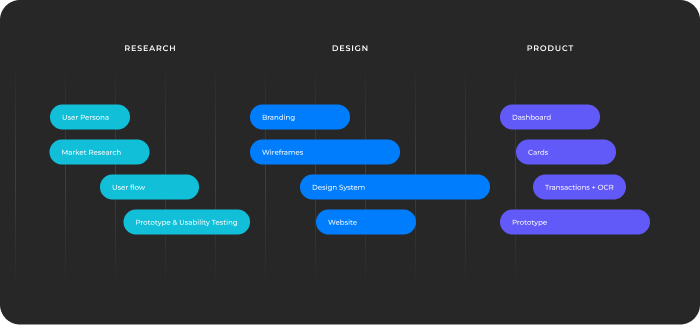

Planning phase

Tight deadlines require a tight plan. To make iterations quickly, our team was in contact with the Lipefi team daily. We divided the work between three people, initially working simultaneously on the look & feel, user flows, wireframes, and the design system.

We have modified the process to provide the client with the greatest possible value within time and budget constraints.

We believe that well-described and planned work equals a well-organized scope for the future. Why was this so important?

- Clarifying every major feature and requirement before we started working on it meant no wasted time or resources on something unnecessary.

- UX testing and market research increase the chances that we are building a product that actually can succeed.

- Keeping within budget.

Market research

We researched extensively to ensure the product meets startups’ unique needs and aligns with our client’s business goals. This included hosting workshops to understand our target audience and their challenges, enabling us to identify startups’ specific financial management requirements.

Additionally, we thoroughly analyzed business requirements and conducted a competitive analysis to ensure Lipefi’s product stands out in the market. Back then, we found no direct competition for Lipefi—their offering targeted a niche! However, companies were already targeting different customer segments in the field, which gave us some references.

Finally, to better understand end users, we created user journey maps outlining the interactions and touchpoints that company owners, managers, and employees have with the product.

Our scope of work

User persona

Recognizing the distinct needs and expectations of each user type, we developed three personas representing the company:

- Owner

A company owner needs stable financing and an easy way to track spending. A high credit limit is usually welcome, which often proves difficult for startup owners. Lipefi aims to offer higher limits thanks to its innovative machine-learning algorithm for assessing creditworthiness quickly and securely. It is the most important part of Lipefi’s intellectual property.

- Manager

Managers require a tool to set limits for particular teams and persons and monitor the department’s spending.

- Employee

Employees need a seamless way to report expenses and user-friendly access to funds to fulfill their job obligations.

Recognizing the distinct needs and expectations of each user type, we developed three personas representing the company:

After workshops, the deep understanding of user personas allowed us to align the final product functionalities with their specific requirements.

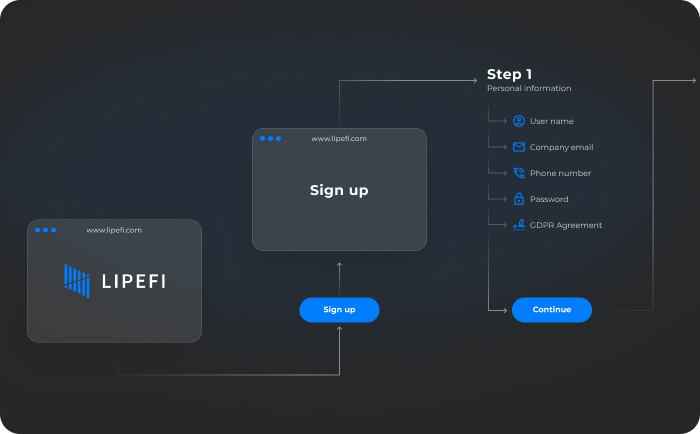

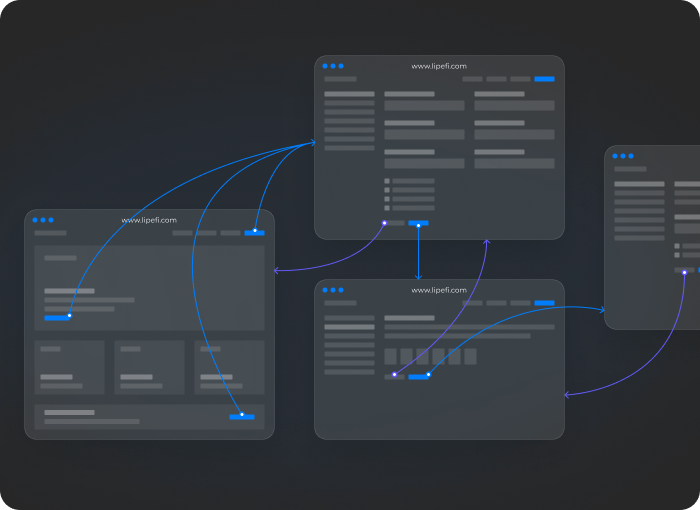

User flow

Building on the user journey mapping for each persona, we created user flow diagrams to illustrate the steps and interactions involved with Lipefi’s product. These diagrams played a key role in guiding our ongoing work on the project.

We designed the initial user journey step with Lipefi, focusing on the homepage and registration flow. The registration process may seem lengthy, but we streamlined it to be significantly shorter even than typical bank procedures. The data provided in the registration form are used to verify the credit-taker and determine the credit limit.

Upon completing this step, the prospective customer, such as a startup owner, receives a preview of Lipefi’s finance management tool. Once the credit limit is established, the customer will be notified and can fully experience the capabilities of Lipefi’s product.

“It [user flow] helped me organize the structure in my head”

Wireframes

Using the aforementioned user flows as a foundation, we then developed low-fidelity wireframes to ensure the best possible user experience. We made iterations after frequent meetings with the team and the client. We also clarified some technical details with the backend developer at that point.

These wireframes served as a blueprint for the product, helping us refine the layout and functionality before moving on to more detailed design work. This way, we saved lots of resources and lowered the cost of introducing changes to the final design and the prototype.

Prototype and usability testing

With the wireframes finalized, we created a clickable low-fidelity prototype to test the product’s usability and gather feedback at an early stage. It enabled us to identify and address any shortcomings quickly.

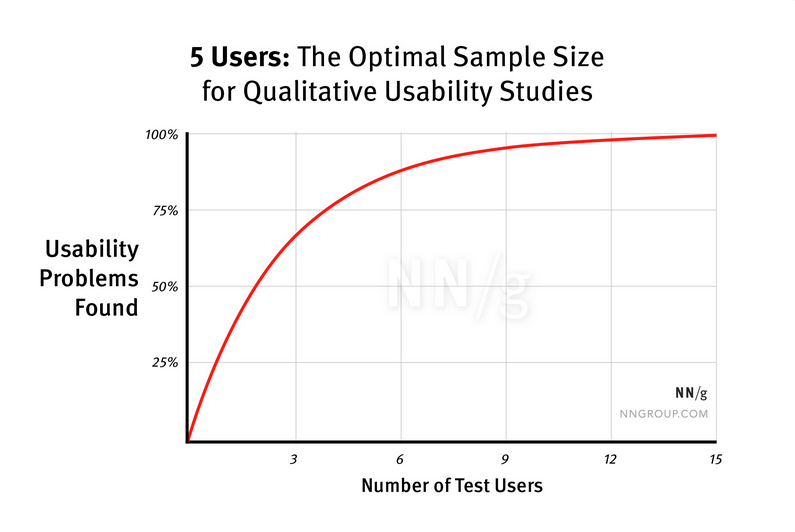

By testing the prototype early on, we minimized costs and potential errors down the line. We conducted this usability testing with just a couple of participants, which did not take much time and allowed us to gather valuable insights.

According to the article “Why You Only Need to Test with 5 Users” by Jakob Nielsen, as few as five participants spot 80% of usability problems, which is the optimal sample size for qualitative usability studies. Yes, THE Nielsen who is a co-founder of Nielsen Norman Group and the author of Nielsen’s heuristics, dubbed the king of usability.

Thanks to “instant” prototyping, we received the first user feedback on the third day of work!

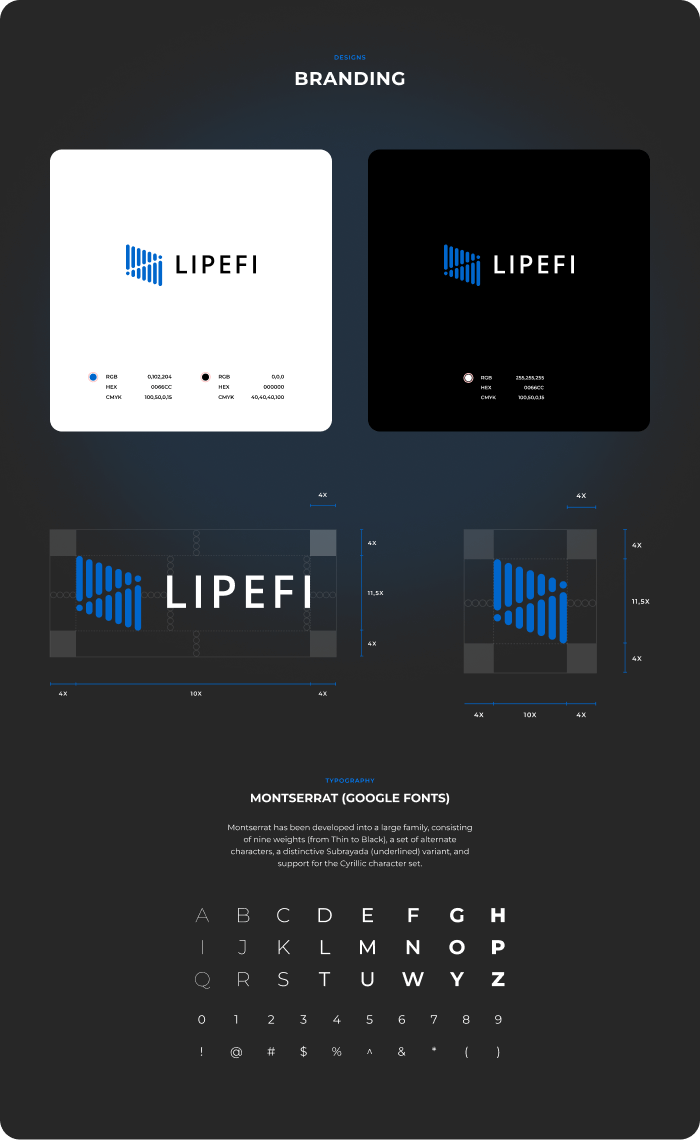

Branding

We also refreshed Lipefi’s brand identity as part of our design process. This included creating a new logo, selecting a suitable font, and determining the color scheme.

The visual language of Lipefi’s brand was carefully crafted to align with our client’s values and desired market positioning. The new brand identity reflects an elegant, modern, and trustworthy image for Lipefi.

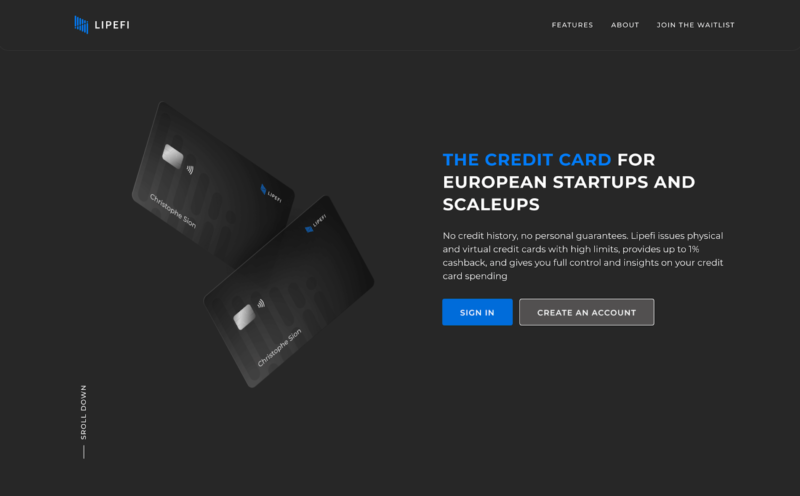

Sign-up form landing page

We designed an elegant website for Lipefi with a user-friendly sign-up form. Based on the information provided in the form, the customer is given a certain credit limit—the whole procedure is much faster than in banks. At the end, the customer sees a preview of Lipefi’s application.

Design system

The proposed design system enables the product to expand and evolve. Although an initial time is invested in its construction, the benefits are substantial—particularly when making changes and enhancements and adapting the design for various screen sizes.

We neatly organized the components into atoms, molecules, and templates to accelerate the development of the functionalities.

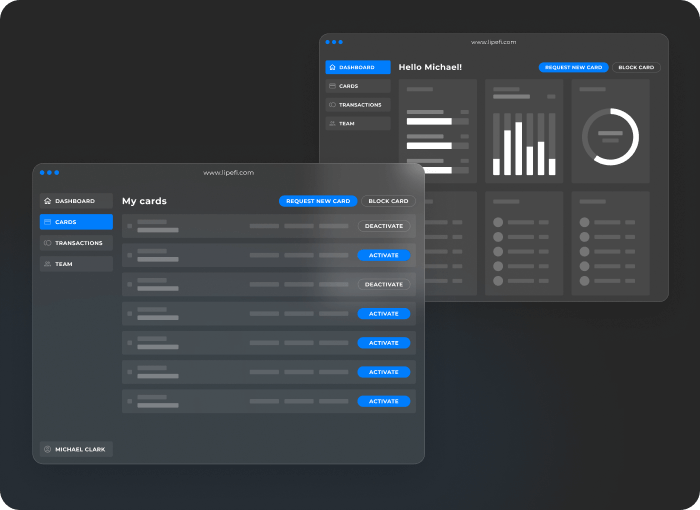

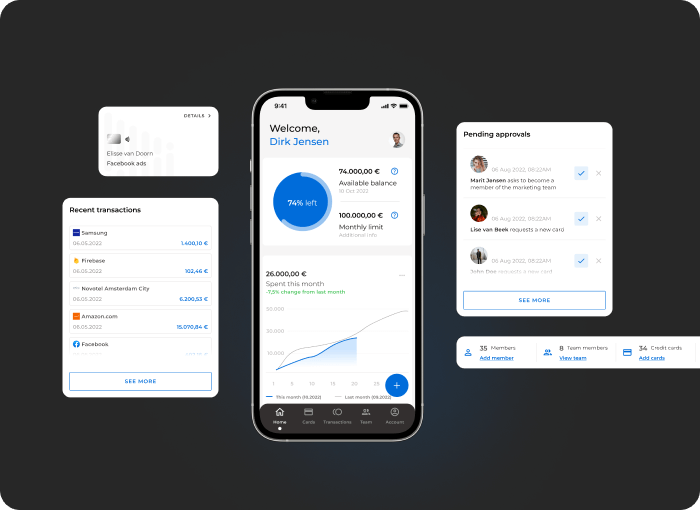

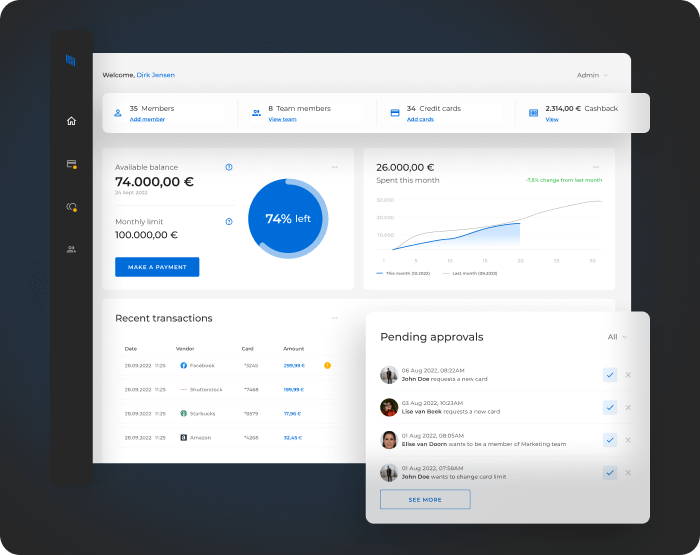

Dashboard

The dashboard is designed to make crucial information easily accessible and visually appealing. It caters to the specific needs of different users, e.g.

- Owners effortlessly view overall expenses and credit limits, providing a comprehensive overview of their company’s finances.

- Employees have a simplified view, focusing on individual spending and remaining credit limits, ensuring a user-friendly experience tailored to their needs.

Cards

Lipefi’s product boasts a notable feature— the incorporation of both virtual and physical cards:

- Virtual cards are meticulously crafted for platforms like Google or LinkedIn Ads, assigned to employees with a designated purpose, and limited to specific uses, such as ads.

- Physical cards provide greater flexibility, enabling employees to receive a card with a predefined limit. Spending from the card can be restricted to certain categories (though it is not mandatory). A dedicated dashboard within Lipefi’s application empowers employees to monitor their spending structure and track their remaining limits with a few clicks.

Transactions & OCR (Optical Character Recognition)

The company owner has comprehensive access to all transactions, supported by Lipefi’s robust filtering options to facilitate thorough data analysis.

Utilizing OCR, employees streamline the expense tracking process. For instance, when an employee makes a purchase (a business dinner at a restaurant), they just need to take a photo of the receipt. The system automatically recognizes and populates all essential information required to register the cost, eliminating the necessity for manual data entry. Users promptly review the information for accuracy and make adjustments if necessary, simplifying and expediting the overall process.

Fully functional prototype in 3 months!

The culmination of our efforts was a fully functional prototype designed to showcase the product concept to potential investors and persuade them of its viability.

The website exudes elegance and simplicity, mirroring the service Lipefi provides.

Lipefi’s idea for prototyping was a lucrative success, as they received investors’ funding.

We predict more success in the upcoming future. 🎉

A great tool to convince investors to rain money

Rapid prototyping is a powerful tool for convincing investors to fund a project as a tangible proof of concept and demonstration of development progress. Prototype helps to:

- Visualize the idea

Investors can see a working model or product instead of just hearing about an abstract idea. This makes it easier for them to grasp your concept and understand its business potential.

- Reduce risks

Investors are more likely to fund a project that has demonstrated viability, and a prototype shows that the idea is feasible, which reduces the perceived risk.

- Receive feedback

Rapid prototyping allows for quick iterations based on real user feedback—in Lipefi’s case, it only took three days to learn what users need. This shows investors that the team is adaptable and focused on product-market fit, making the investment more promising.

- Demonstrate your commitment to the project

Having a prototype shows that the business founders have already invested time, effort, and resources into the project. It signals seriousness and commitment, which are critical to building investor confidence.

- Ensure investor confidence

Seeing a functioning prototype allows investors to assess the potential for scalability, market impact, and future development. It turns a concept into something more concrete, giving them confidence in the potential returns on their investment.

Like Lipefi, go from concept to capital with a powerful prototype

Ready to turn your fintech vision into a reality?

At The Software House, we specialize in prototyping, which helps you secure investor funding and stand out in the competitive market. Whether you need a proof of concept or a fully functional MVP, our team is here to make it happen.