All-in-one fintech software development

Kick-start your fintech project with a team that feels like yours

Need a partner that already worked with fintechs or banks? Let’s talk. Fintech executives rate us ★4.8/5 because we help them build scalable and inventive products users appreciate.

Proven track record with the Fintech industry

Your development will become faster and improved

We know. You need to grow the team soon and can’t babysit developers. The experts waiting here offer advanced expertise in working with the cloud, microservices, and serverless. And they’re pretty cool.

Start working with them in just weeks. They already know how to build flexible cloud architecture for fintechs and how to integrate most-wanted services. So you’ll see the results in the first sprint.

160+

projects delivered

98%

referrals

2-3

years

We use the tools Fintechs need

Mambu

Cloud banking platform. An adjustable SaaS system supporting rapid innovation and outstanding customer experience. Used by Raiffeisen Bank and Tide.

A team that understands your field

The financial industry challenges we deal with

Your new team of developers, cloud engineers, and DevOps can deal with technology problems fintechs face on the road to millions of users. Add or remove members on the go.

- Full-stack web development See the answer

- AWS cloud set-up See the answer

- Payment service integration See the answer

- Cloud cost optimization See the answer

- Law and security compliance See the answer

“They’re really becoming a part of our organization”

As said by Bart van Muijen, GoConnectIT’s CTO, who’s been with us for 3 years. Connect with the software experts he rates as ★5 collaborators.

What do technology leaders say?

Hear from our partners

We’ve been working with The Software House for four years. They do such an excellent job at keeping projects on the track that I can now focus on the business areas of our products.

This team is more skilled than the ones I’ve worked with previously. The Software House has invested in developing their engineers and bringing them to a new level, adjusting to the market’s needs

Growth-oriented development

Fintech case studies

The market’s pace of change is challenging. The Board has unbending expectations. And then you have your users who can switch their platform if there are too many bumps.

You need a forward-thinking partner who knows how to develop at a scale from a national to a multi-country level. These companies needed that too — see how much they achieved.

160+ delivered projects in over 24 countries

Services

01 Build a digital product

Fintech software development services — from building an app through scaling to ongoing maintenance. We code in Node.js, React, Laravel, and Symfony.

02 Scale up a team

Add to your ranks JavaScript experts who are top-rated in Europe. Among them — certified AWS cloud developers, DevOps, and Project Managers. 220+ talents available.

03 Create a development plan

Tap into our 9 years of best practices tested with companies of 10-250 people. We’ll explain how to set up the architecture and secure the product’s scalability and resilience.

04 Use cloud computing

Migrate an app, a service, or a system onto AWS. Or build the software in the cloud. Expect cuts to maintenance costs and worldwide high availability.

“They are all super friendly and reliable”

This comes from Uberchord’s CTO Eckart Burgwedel. Let’s have a private chat about your product growth plans.

From our blog

Discover how we think and work

Over 1.2M people visit our blog in a year to hear from our CTO and developers you might be working with.

Tried & tested

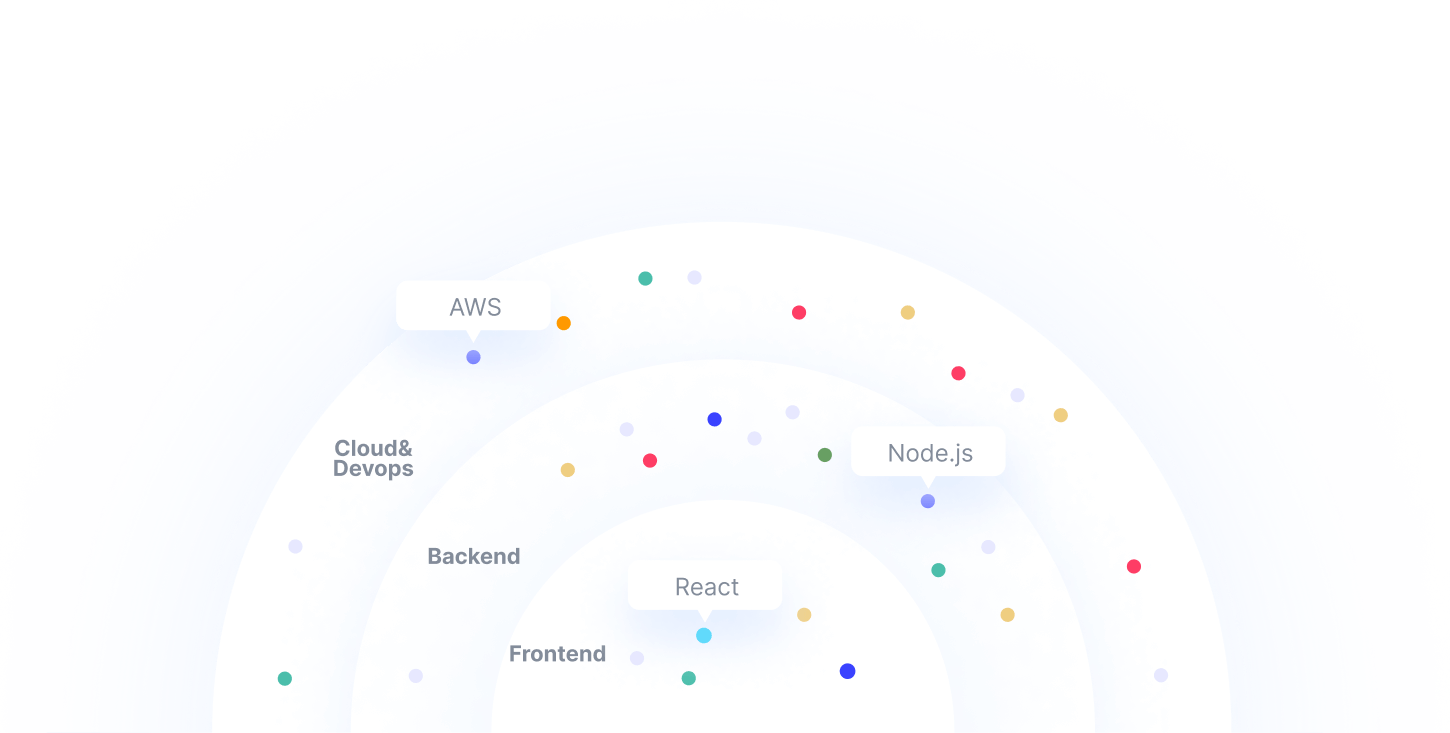

Our core technologies

Backend

Node.jsCloud & Devops

AWS Cloud ServicesMeet the people who care

Looking for a partner that

will be a match?

It’s hard to recruit employees that your folks accept. So fin them here! We lead a culture of openness that offers you sociable product teams ready to rock the keyboard.

Here, best practices matter, initiative is welcome, and helpfulness is a standard. The result? Projects are well managed, fun, and without stress.

Very nice office, good specialist, ambitious projects

Current Contractor

One of the best software houses in Poland

Former Lead Developer

Many smart people you can learn from

Current Contractor, Engineer

Great company to be part of

Current Contractor, Engineer

Tell us about your project

Transform the financial technology you have into something greater with a one-stop-shop development partner. Fintech innovation starts here.

- Click the button below and select your goal

- Say a bit about the challenge of problem you’re facing

- We’ll reach you in 1 day to explain what we can do together

Frequently asked questions

What type of financial institutions and fintech software companies have you worked with?

For now, we can only mention projects with:

- A traditional bank that moved technology onto the AWS cloud with us. We used React, Serverless, and Node.js. Our design team later helped to rebrand their product’s UX/UI.

- A fintech with a B2B lending platform we supported with business logic work and development in React and Node.js plus Python.

- Another fintech called Energy Web (case study). They asked us to build a solar battery grid management app based on AWS, Ethereum, and Node.js.

- And yet another one called Arantio, where the founders flipped an intranet app into a payment processing platform for companies granting employee benefits

That experience plus 10 years of know-how can work for you.

We’re open to doing web development, business analysis, and cloud engineering work for traditional banks and fintech scale-ups. Representing a fintech software development company? Sure, let’s team up.

And if you need consulting services to failproof your strategy, guess what — your friend here can help too.

What services for the financial industry can you integrate?

We had success with connecting 8+ fintech-specific services that offer:

- EU, US, UK, and international payments in EUR with the set-up needed to earn the SEPA certificate

- International transfers in dozens of currencies

- 4 different payment gates that allow fintechs to accept debit plus credit cards, PayPal-like instant payments, and Google and Apple Wallet transfers

Simply put, expect your product to get packed with features all fintechs desire. Or as Microsoft would say it — “Introduce innovative business solutions today!”

Where can I find your previous projects from finance industry?

Check out our Portfolio website and filter the “Fintech & Banking” projects on the Industry panel on the left side.

My product requires extreme safety measures. What are your security standards?

The quality and security of the solutions we create are our top priority!

We employ tools like SonarQube, which adheres to the best OWASP practices for static code analysis. Moreover, in each project, we enforce minimum required access levels for all team members. To achieve this, we utilize tools such as 1Password and Azure Active Directory. These serve as gateways to all services accessible by team members.

We maintain restricted access to our infrastructure, allowing specific and essential tool access. As an AWS Advanced Partner and Well-Architected Partner, our dedication revolves around crafting solutions that emphasize both security and scalability.

AWS Security Foundations we follow

AWS Well-Architected

Our developers undergo security training and have AWS Certified Security – Speciality certification in this area.

- Offensive Security Certified Professional

- Certified Kubernetes Security Specialist (CKS)

- Microsoft Azure Security Technologies (AZ-500)

The AWS certifications in the TSH team (they grow monthly!):

- 53 x AWS Certified Cloud Practitioner

- 2 x AWS Certified Database – Specialty

- 3 x AWS Certified DevOps Engineer – Professional

- 10 x AWS Certified Developer – Associate

- 1 x AWS Certified Machine Learning – Speciality

- 4 x AWS Certified Security – Specialty

- 15 x AWS Certified Solutions Architect – Associate

- 5 x AWS Certified Solutions Architect – Professional

- 3 x AWS Certified SysOps Administrator – Associate

How many developers from your software development company can I have in my team?

Let’s face it. You could use a technology partner that lifts you throughout years, and that’s why we’re ready to offer you a product team of 2 to dozens of experts.

One client that stayed with us for 6 years grew the team to 20 professionals.

You’ll also have the freedom to scale up or down depending on workload, and to delegate a project in full by adding one of our very convincing PMs to the group.

Why should I trust you? How my business benefit from partnership with The Software House?

You’ll enter cooperation with a stable company from the European Union recognized for business growth and compliance with legal and security standards (Deloitte, Clutch, Financial Times, Computerworld).

We have vast experience with international financial and banking institutions in:

- integrating websites, tools, and services mostly used by fintech,

- cloud banking projects,

- loan-providing projects,

- integrating payment gateways,

- implementing authorization services,

- implementing legal regulations,

- adjusting modern tech stacks for scalability and flexibility,

- keeping firm adherence to project safety procedures.

What are your standards when cooperating with fintech?

Flawless integrations

There are lots of third-party tools and technologies with stable market position. Instead of reinventing the wheel, we work with solutions that have already been used by the industry and will integrate them with your platform.

Diligent compliance with the law

Fintechs need a license to operate. We understand the need for a legal department to verify the correctness of operations according to industry standards so that you don’t lose the license. We would never allow this.

Flexible architecture

Banks tend to be slow. Fintechs have to work faster, otherwise they will not be as attractive as traditional institutions. At the same time, fintechs are more respectful and adaptable to customers’ opinions and needs. Therefore, a software architecture must be easily modified.

We’ll help you take care of your customers.

The highest degree of cybersecurity

Leaking user data is unacceptable, and after an incident like that, fintech may even face the payment of GDPR penalties or potential bankruptcy, and never rebuild their reputation with investors and customers back.

Protecting the copyright of your code

Every line of code written is protected by copyright until the author waives such rights. Fintechs must be careful to always have the right to the code used before someone leaves the company, otherwise, they may not be able to ensure the legal operation of their product.

Which legal regulations are you familiar with/worked with?

- Transfers in Euro – EBA Clearing,

- User verification – KYC/AMLDORA (Digital Operational Resilience Act),

- GDPR (General Data Protection Regulation),

- Custom cybersecurity policy,

- Employee screening,

- Code license checks.

5/5 on

5/5 on